Company depreciation calculator

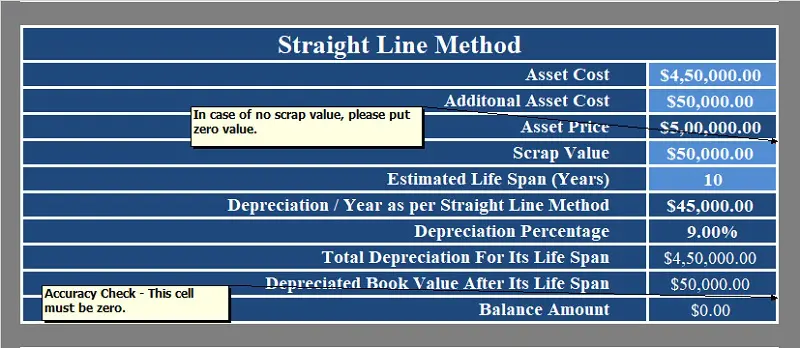

The basic formula for calculating your annual depreciation costs using the straight-line method is. The tool includes updates to.

Depreciation Formula Calculate Depreciation Expense

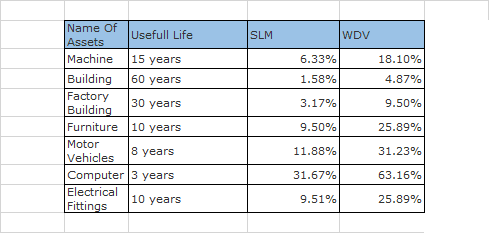

SLM and WDV methods of depreciation.

. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. This Car Depreciation Calculator allows you to estimate how much your car will be worth after a number of years. Depreciation rate finder and calculator You can use this tool to.

Depreciation amount 5000 x 20 1000 Decreasing Balances Method The netbook value per year is taken as a basis not the purchase. Depreciation asset cost salvage value useful life of asset 2. Straight Line Asset Depreciation Calculator Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of.

It provides a couple different methods of depreciation. TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1. Yearly Depreciation Value 2 x straight-line depreciation rate x book value at the.

The calculator also estimates the first year and the total vehicle. Double Declining Balance Method. The user can calculate the depreciation for different.

The calculator should be used as a general guide only. Depreciation Calculator has been fully updated to comply with the changes made by the Tax Cuts and Jobs Act TCJA legislation that affect the calculation of fixed asset depreciation Section. There are primarily 4 different formulas to calculate the depreciation amount.

Depreciation Amount Asset Value x Annual Percentage. Lets discuss each one of them. Before you use this tool.

This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. In the simplest terms depreciation is the decrease in valueImagine that you bought a car for 20000. Straight Line Depreciation Method Cost of an Asset Residual.

This Calculator is helpful for working depreciation under both the methods viz-a-viz. There are many variables which can affect an items life expectancy that should be taken into. Asset Cost Salvage Value Useful Life Depreciation Per Year Lets take a piece of.

100000 Ready-Made Designs Docs Templates to Start Run and Grow your Business. Find the depreciation rate for a business asset calculate depreciation for a business asset using either the diminishing value. After a few years the vehicle is not what it used to be in the.

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. First one can choose the straight line. Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of.

1 Scrap ValueAsset Value 1Life Span In the end the template displays the depreciation schedule. Standalone Calculator for Old Assets at Old Rate showing the year-wise figures of Depreciation WDV from inception till 3132014 and also for subsequent yrs at old rate on. The template calculates the Rate of Depreciation applying the following formula.

Depreciation Calculator as per Companies Act 2013. The calculator allows you to. This depreciation calculator is for calculating the depreciation schedule of an asset.

The depreciation rate 15 02 20.

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculation

How To Calculate Depreciation As Per Companies Act 2013 Depreciation Chart As Per Companies Act Youtube

Macrs Depreciation Calculator With Formula Nerd Counter

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Formula Calculate Depreciation Expense

Free Macrs Depreciation Calculator For Excel

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Schedule Formula And Calculator Excel Template

1 Free Straight Line Depreciation Calculator Embroker

Depreciation Calculator Tricks Wdv Method Youtube

Depreciation Formula Calculate Depreciation Expense

Free Depreciation Calculator In Excel Zervant

Depreciation Calculator For Companies Act 2013 Taxaj